Mortgage Interest Deduction Might Be Cut

SAN FRANCISCO (KCBS) - The incoming Congress is expected to seriously consider ending a tax break that American homeowners have enjoyed for almost a century.

Since 1913, many Americans with mortgages have been able to deduct the interest, saving thousands of dollars a year in taxes.

The deduction makes home-buying more affordable. But is it time to phase out that deduction?

KCBS' Doug Sovern Reports:

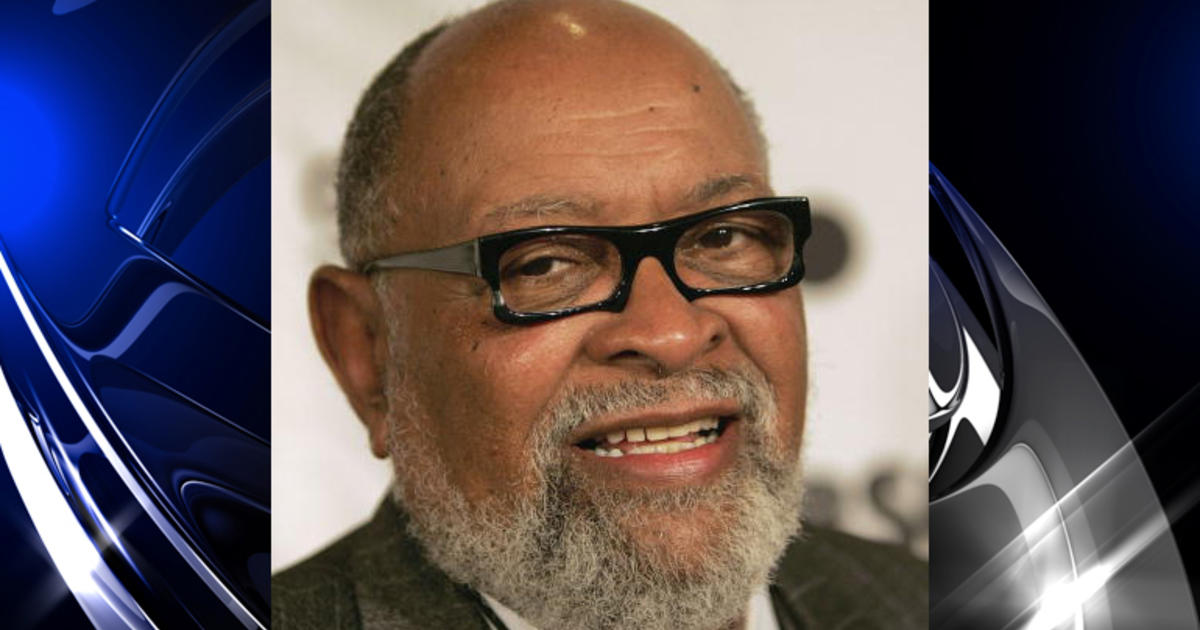

"Certainly, having people buy homes that they can't afford to live in doesn't make a lot of sense," said UC Berkeley tax policy economist Alan Auerbach.

He said the new Republican-led House may replace the deduction with a tax credit, or simply eliminate it, which Auerbach said would be smart, economically.

"The way the tax benefit is structured, it just gives you a larger and larger benefit the bigger and bigger house you buy," he said. "It also gives a bigger benefit to high income people."

But Charles Moore, CEO of McGuire Real Estate in San Francisco, said changing it now would cripple the already reeling housing industry.

"Would it hurt the market? Yes it will, short term and long term. It's the wrong time to do it, especially when we're on life support as it is," said Moore.

Realtors associations are launching a preemptive ad campaign to convince Congress to leave the deduction alone.

(© 2010 CBS Broadcasting Inc. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed.)