ConsumerWatch: Some Customer Rewards May Lead To Mysterious Charges

SAN FRANCISCO (KPIX 5) -- Take a good look at your bank statement or credit card bill and there's a decent chance you'll find a mysterious charge for something you never purchased or can't remember buying.

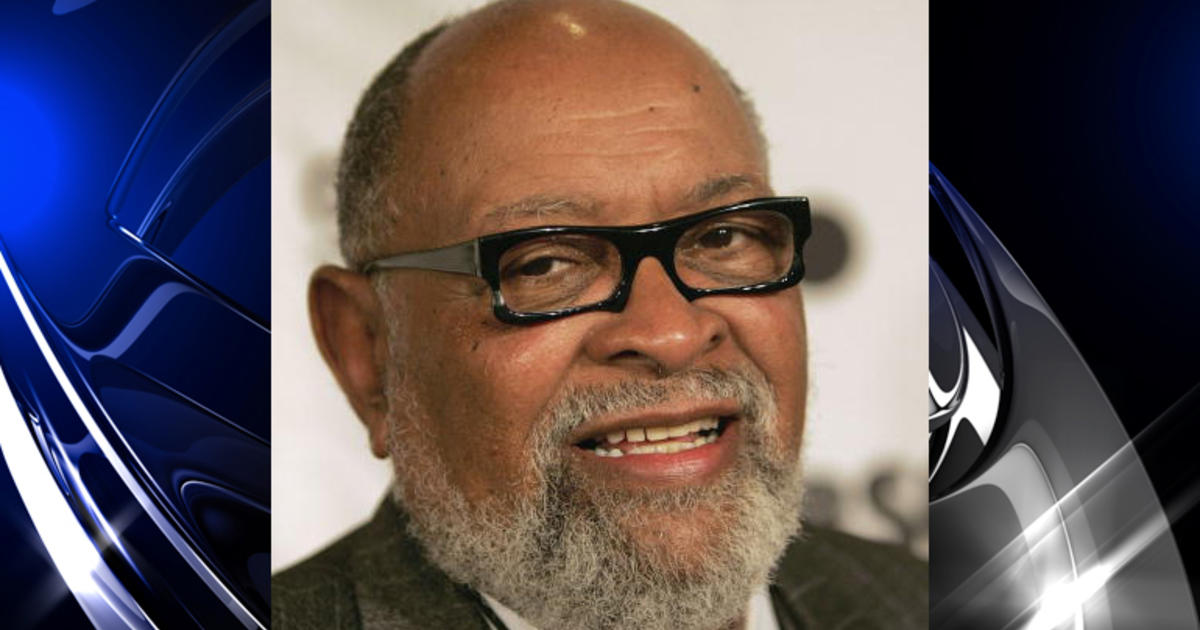

They are known as "gray charges," and Bay Area-based financial advisor David Hollander estimates that one-in-four consumers are currently paying them in the form of unwanted subscriptions, auto-renewals and rewards programs.

Marilyn Maffly recently found a slew of grey charges buried in her credit card statements. Earlier this week, the retired R.N. discovered two separate charges of $14.95 for "rewards" programs from two of her favorite on-line retailers, Appleseed's and Draper and Damon.

Related Link:

BillGuard

When Maffly reviewed her bills from the past year, she noticed 15 identical charges from the same retailers, totaling about $260. "They were familiar companies and I didn't pay enough attention," Maffly told ConsumerWatch.

It turns out Maffly inadvertently got enrolled in the program while making purchases, thinking she was getting free shipping. But she said neither of her purchases was actually shipped for free. "I'm not getting any rewards," she said.

Dealing with the charges has been a headache for Maffly. When she called the 800 number listed next to the charge on her credit card bill, she said a representative offered sympathy, but no help.

"She said that was the best she could do. [The representative] did say 'well, I order things from Amazon, and they pay all the shipping and return it if it isn't right, there's no problem with Amazon,'" Maffley recounted.

Maffly is not the only one complaining about recurring $14.95 fees from online clothing company's rewards programs. ConsumerWatch found hundreds of complaints online from consumers who say they are also getting monthly bills for reward programs they don't want and didn't sign up for.

Many of them were billed by a third party called "Encore Marketing International," that has an F rating from the Better Business Bureau. Encore did not return ConsumerWatch's request for comment.

Ken Abbe of the Federal Trade Commission said these types of charges can be illegal if the company does not clearly disclose the conditions of the offer.

"It's the law, if you're going to charge someone for something, you have to disclose that upfront in a way that people can understand," Abbe said.

Abbe suggested as soon as you notice an unwanted charge to call the 800 number on your bill, as Maffly did. If that doesn't work, contact your bank or credit card company and have them dispute the charge.

Since Maffly contacted Consumerwatch, we contacted the parent company of the two clothing companies involved. The company agreed to give Maffly a full refund.

Some consumer advocates recommend a free product called BillGuard that monitors your statements and flags suspicious charges.

(Copyright 2013 by CBS San Francisco. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed.)