5 Bay Area Stock Charts That Are Just Plain Ugly Monday Morning

Editor's note: By 9:30 a.m., many of the below stocks had recovered, and AAPL was actually showing gains for the day.

SAN FRANCISCO (CBS SF) - Bay Area residents who have their retirement plans tied to company stock may want to be sitting down when they check the stock market Monday morning.

The DOW's record intraday plunge saw big drops in blue chips, but the pain was felt across the market. The drop followed huge losses in Chinese stocks. The benchmark Shanghai Composite Index fell by 8.5%, its biggest margin in 8 years.

After the 1000-point slide, losses were cut in half, but volatility continued to spike at all-time highs.

Here's a look at the weekly stock charts for 5 big name Bay Area employers. In each case, the week was trending poorly before Monday's big selloff and attempted rally. All images courtesy of CBS MoneyWatch.

Facebook (FB):

Like all the other names on the list, Facebook fell off a cliff shortly after open, briefly dropping below $80 a share before clawing back. $80 represents a full $15 drop in share price over the last week. The stock had rebounded to around $83 by 8 a.m.

CISCO (CSCO)

Cisco was having a rough end to August even before Monday's slide. As you can see from the weekly chart above, the stock wasn't as quick to rebound as some others Monday morning. As of 8 a.m. the tech giant was off about 3.5% for the session.

Wells Fargo (WFC)

Wells Fargo has given up chunks of ground two or three times over the past week, but nothing like Monday morning's drop of $2 per share in the early going.

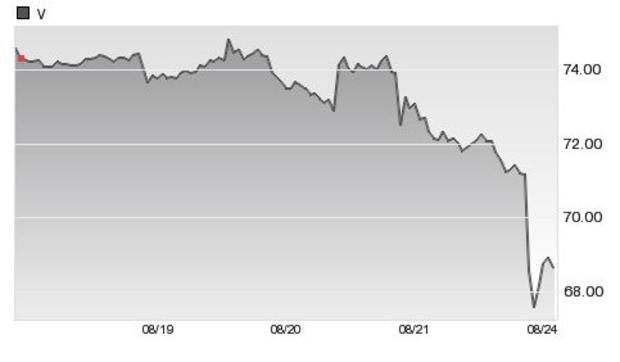

Visa (V)

Visa briefly slipped below $68 per share Monday, essentially doubling the decline it the stock price had seen over the last week.

Apple Inc. (AAPL)

As you can see from the above, Apple was trading around $117 a share just last week. As of Monday morning, the stock was on the mend after dipping to $102 per share.

Track the latest movements in the market at CBS MoneyWatch.