Wells Fargo CEO John Stumpf Resigns In Wake Of Fake Accounts Scandal

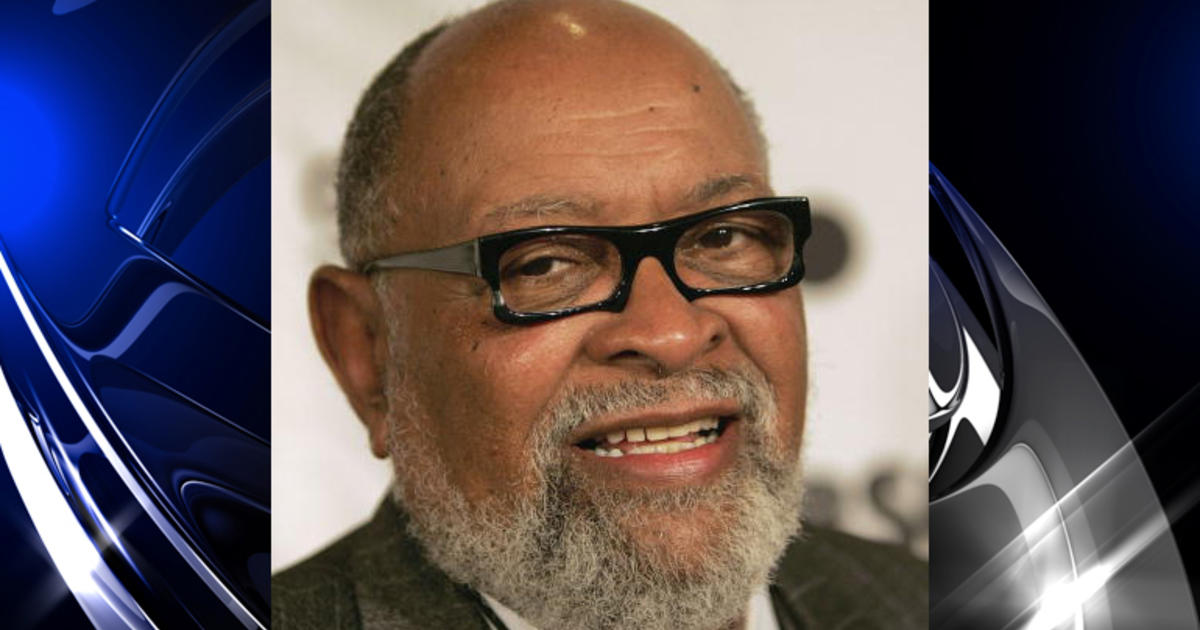

SAN FRANCISCO (CBS SF & AP) -- Wells Fargo CEO John Stumpf will resign, effective immediately, in wake of scandal over bank's sales practices, the bank announced Wednesday.

Wells Fargo Board of Directors have elected Tim Sloan, the company's President and Chief Operating Officer, to succeed Stumpf as CEO, and Stephen Sanger, its lead director, to serve as the Board's non-executive Chairman and independent director Elizabeth Duke to serve as Vice Chair.

"John Stumpf has dedicated his professional life to banking, successfully leading Wells Fargo through the financial crisis and the largest merger in banking history, and helping to create one of the strongest and most well-known financial services companies in the world," Sanger said in a prepared statement.

Stumpf, a 34-year veteran of the bank, joined Wells Fargo in 1982 as part of the former Norwest Bank, becoming Wells Fargo's CEO in June 2007 and its chairman in January 2010.

"I am grateful for the opportunity to have led Wells Fargo," Stumpf said in a prepared statement. "I am also very optimistic about its future, because of our talented and caring team members and the goodwill the stagecoach continues to enjoy with tens of millions of customers."

"While I have been deeply committed and focused on managing the company through this period, I have decided it is best for the company that I step aside."

California State Treasurer John Chiang, who has pulled millions in state business from the bank, welcomed the news of Stumpf's resignation.

"Today's announcement that Mr. Stumpf is stepping down is welcome news," Chiang said in a prepared statement. "Based on his duck, dodge, and deny performance in the wake of admissions that his bank had fleeced legions of its own customers, he was not – and would never be – the change agent leader Wells Fargo so desperately needs...My hope is that this leadership change will restore within Wells Fargo the sense of fiduciary duty it owes to everyone who entrusts their financial health to the bank's care."

Stumpf has been under fire ever since federal and local authorities revealed that Wells Fargo & employees trying to meet those targets opened bank and credit card accounts, moved money between those accounts and even created fake email addresses to sign customers up for online banking -- all without customer authorization.

Debit cards were also issued and activated, as well as PINs created, without customers' knowledge.

Meanwhile, the Labor Department is investigating whether Wells Fargo abused its employees while driving them to meet the lofty sales targets. The bank says it has refunded to customers $2.6 million in fees charged for products that were sold without authorization.

In hearings before Congress, several lawmakers, both Republican and Democrat, alleged that Wells Fargo's sales practices may have violated federal laws, including the federal racketeering laws, which would constitute a criminal offense.

Federal regulators have not said if they have referred the Wells Fargo case to the Department of Justice.

Stumpf reiterated his previous words at the Congressional hearing, that he was "deeply sorry." He said the bank was looking at accounts further back, to 2009, and that an inquiry by Wells Fargo's outside directors will review executives' roles "across the board."

The bank says customers already have been refunded $2.6 million in fees from unauthorized products.

Other actions taken in the wake of the scandal include:

- The Justice Department and the Office of the Comptroller of the Currency issuing a total of $24.1 million in civil penalties for alleged violations of a law intended to protect military service members from predatory financial practices.

- California and Illinois pulling several billion dollars worth of business from the bank.

- The Wells directors announcing that Stumpf would forfeit $41 million in stock awards, while former retail banking executive Carrie Tolstedt will forfeit $19 million of her stock awards, effective immediately.

RELATED:

- Lawmakers Question Wells CEO On Sale Of Bank Stock

- California Withdraws Business From Wells Fargo

- Wells Fargo CEO Forfeits $41 Million In Stock Awards Over Fake Accounts Scandal

TM and © Copyright 2016 CBS Radio Inc. and its relevant subsidiaries. CBS RADIO and EYE Logo TM and Copyright 2016 CBS Broadcasting Inc. Used under license. All Rights Reserved. This material may not be published, broadcast, rewritten. The Associated Press contributed to this report.