Credit Reporting Firms To Change How Scores Are Determined

SAN FRANCISCO (CBS SF) – The three major credit-reporting firms are about to change the way they determine your credit score, which could be good news for millions of Americans.

A tax lien can really slam your credit score. But the Wall Street Journal reports the big three, Equifax, Experian and TransUnion will stop using tax liens and civil judgements to figure your credit score if they don't have at least three data points: a person's name, address and either a Social Security number or date of birth.

Consumers can thank the Consumer Financial Protection Bureau for the change.

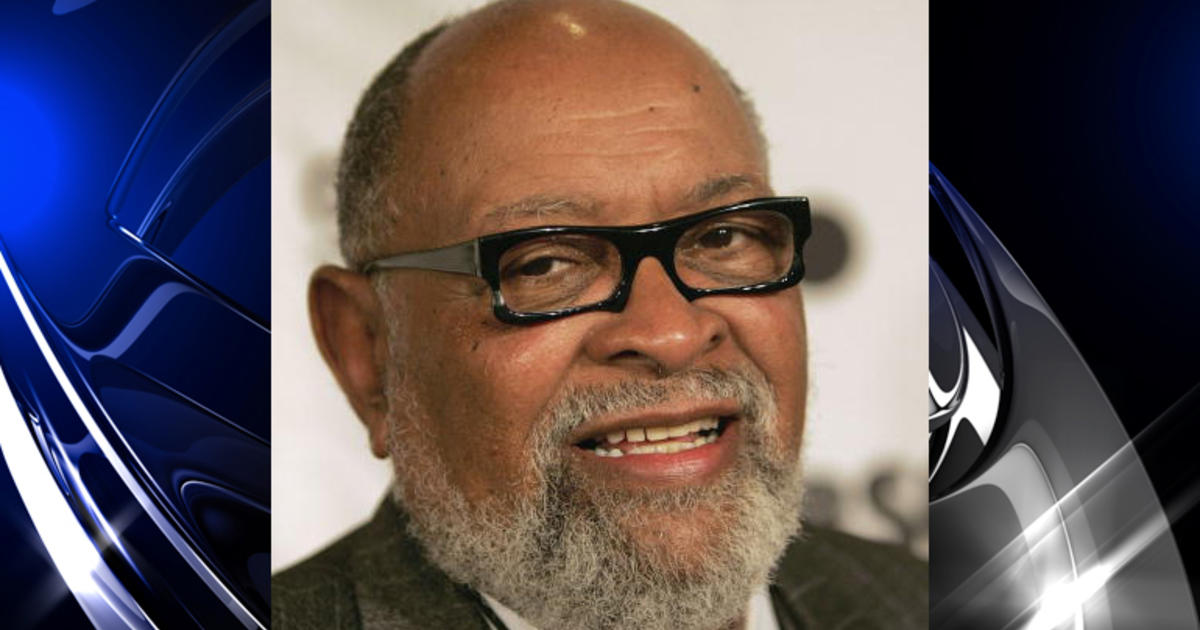

Evan Hendricks, author of "Credit Scores and Credit Reports: How the System Really Works" said the court records that include tax liens and judgements have been a long-standing problem. They are often missing necessary information that can lead to cases of mistaken identity.

"Either you have the identifiers to have a reasonable amount of certainty, this lien belongs to that person, or you don't put it on," Hendricks told KCBS. "And so that's a positive change."

Hendricks expects to see California and other states in a "race to the top" to come up with the toughest law. That will likely end up serving as a goal for other states in the coming year.