CBS News Live

CBS News Bay Area: Local News, Weather & More

Watch CBS News

California pet owners struggling to find an apartment that accepts their furry, four-legged family members could have an easier time leasing new housing under proposed state legislation that would ban blanket no-pets policies and prohibit landlords from charging additional fees.

District Attorney Pamela Price on Thursday evening announced she plans to file charges against the three Alameda police officers involved in the 2021 in-custody death of Mario Gonzalez.

Twelve jurors and one alternate were seated in the first three days of jury selection in former President Donald Trump's New York criminal trial.

A disappearing lizard population in the mountains of Arizona shows how climate change is fast-tracking the rate of extinction.

A woman is suing San Jose's Leigh High School and the school district, claiming that after impregnating her as a student, a teacher forced her to have an abortion and then continued sexually abusing her.

The San Francisco Zoo is set to receive a pair of giant pandas under a memorandum of understanding signed Thursday by Mayor London Breed and the China Wildlife Conservation Association.

With the cancellation of the highly anticipated 4/20 marijuana festival in Golden Gate Park, cannabis enthusiasts are shifting their focus from Hippie Hill to local dispensaries.

On Monday, the international community will celebrate the 54th anniversary of Earth Day with events across the world, including a number of celebrations in the Bay Area.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

The San Francisco Giants beat the Arizona Diamondbacks 5-0 Thursday night to open a four-game series.

The Calgary Flames beat the San Jose Sharks 5-1 on Thursday night in the season-ending game for both teams.

Golden State Warriors general manager Mike Dunleavy Jr. and head coach Steve Kerr on Thursday talked about the tough end to the team's season and what lies ahead.

The San Francisco 49ers will no longer be spectators on the opening night of the NFL draft.

The Oakland City Council on Tuesday unanimously approved the Oakland Ballers' plan to spend $1.6 million in upgrades to Raimondi Park, allowing the independent professional baseball team to play its inaugural 48 home games at the West Oakland park.

Watts will raise awareness of serious issues impacting Californians, hold local officials accountable, obtain answers for viewers and provide solutions.

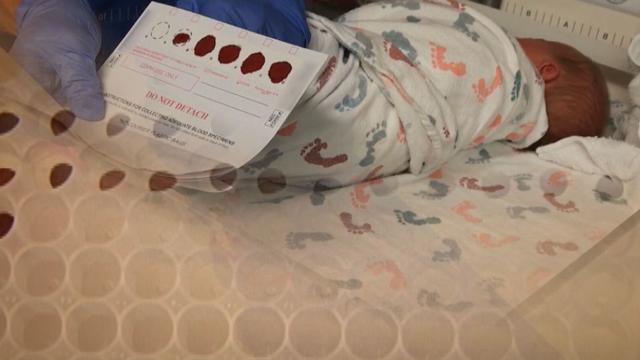

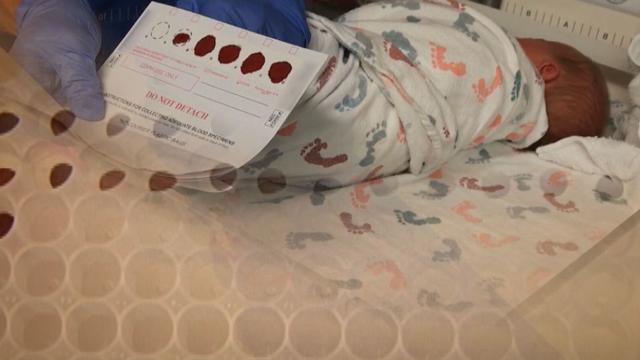

California law says genetic testing companies have to get your permission before they store, use or sell your DNA, but the state itself doesn't have to get your permission and has been storing DNA samples from every baby born there since the '80s. Lawmakers want to change that, but face an uphill battle.

A bill introduced in the wake of our "Handcuffs in Hallways" investigation aims to reduce "unnecessary" calls for police at schools. But one California lawmaker could kill it without a vote.

California pet owners struggling to find an apartment that accepts their furry, four-legged family members could have an easier time leasing new housing under proposed state legislation that would ban blanket no-pets policies and prohibit landlords from charging additional fees.

Twelve jurors and one alternate were seated in the first three days of jury selection in former President Donald Trump's New York criminal trial.

Two U.S. officials tell CBS News an Israeli missile has hit Iran in apparent retaliation for the recent drone and missile attack on the Jewish state.

Gov. Gavin Newsom on Thursday announced nearly $200 million in grant money to cities and counties to move homeless people from encampments into housing.

One week after Oakland International Airport approved adding "San Francisco Bay" to its name, San Francisco officials have sued, claiming the new name infringes on the trademark of San Francisco International Airport (SFO).

An innovative recycling start-up hopes to make the most of "wish-cycling" -- where people try to recycle things like prescription bottles and ballpoint pens, with no evidence they're ever properly processed.

Bay Area musicians are joining forces with an international alliance to call attention to the impact of climate change.

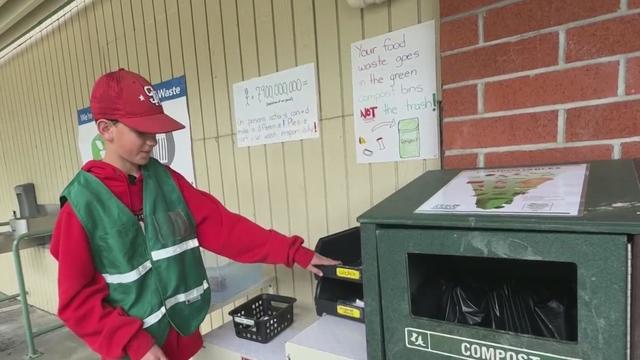

Students at an elementary school in San Rafael have become experts in the field of recycling, and have lessons for others who need a refresher, including those who work at CBS News Bay Area.

The Arctic fox, a captivating creature with a playful nature and distinctive look is under threat.

More than 100 years ago, wild winter-run Chinook salmon from the icy cold McCloud River ended up in the glacially cold mountain waters of New Zealand, where they continue to thrive today.

Chief meteorologist Paul Heggen has the Bay Area microclimate forcast.

Jessica Burch shows how long the sunny spring weather will continue. Website: http://kpix.com/ YouTube: http://www.youtube.com/CBSSanFrancisco Facebook: https://www.facebook.com/CBSSanFrancisco Instagram: https://www.instagram.com/kpixtv/ Twitter: https://twitter.com/KPIXtv

After a warm Wednesday, expect mostly clear conditions in the evening, with some patchy fog. Highs will remain above average on Thursday, with conditions remaining dry into the weekend. Paul Heggen has the forecast. Website: http://kpix.com/ YouTube: http://www.youtube.com/CBSSanFrancisco Facebook: https://www.facebook.com/CBSSanFrancisco Instagram: https://www.instagram.com/kpixtv/ Twitter: https://twitter.com/KPIXtv

Jessica Burch says the midweek weather will be a mix of sun and clouds but the temperatures will climb into the 80s in some areas.

District Attorney Pamela Price on Thursday evening announced she plans to file charges against the three Alameda police officers involved in the 2021 in-custody death of Mario Gonzalez. Andrea Nakano reports. (4-18-24) Website: http://kpix.com YouTube: http://www.youtube.com/CBSSanFrancisco Facebook: http://www.facebook.com/CBSSanFrancisco Instagram: http://www.instagram.com/KPIXtv Twitter: http://twitter.com/KPIXtv

With the cancellation of the highly anticipated 4/20 marijuana festival in Golden Gate Park, cannabis enthusiasts are shifting their focus from Hippie Hill to local dispensaries. José Martínez reports. (4-18-24)

CBS News Bay Area evening edition headlines for Thursday April 18, 2024. Watch full newscasts streamed at the CBS SF website or on the app. Website: http://kpix.com

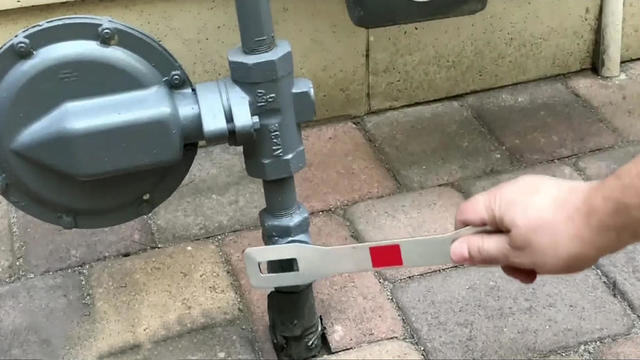

KPIX science editor Brian Hackney asks a seismologist for advice on what to have on hand for the next Big One. (4-18-24) Website: http://kpix.com YouTube: http://www.youtube.com/CBSSanFrancisco Facebook: http://www.facebook.com/CBSSanFrancisco Instagram: http://www.instagram.com/KPIXtv Twitter: http://twitter.com/KPIXtv

An irrigation artery in the San Joaquin Valley being built to replace an earlier, sinking canal is being affected by over-pumping of groundwater. Wilson Walker reports. (4-18-24) Website: http://kpix.com YouTube: http://www.youtube.com/CBSSanFrancisco Facebook: http://www.facebook.com/CBSSanFrancisco Instagram: http://www.instagram.com/KPIXtv Twitter: http://twitter.com/KPIXtv

CBS News Bay Area anchor Ryan Yamamoto talks with Dr. Jyothi Tirumalasetty, Allergy & Immunology at Stanford Health Care, about this spring allergy season being worse from last, reasons why, and what we can do to minimize reactions.

Rep. John Garamendi (D-Walnut Grove) discussed Iran's air attack on Israel Saturday with KPIX anchors Brian Hackney and Andrea Nakano. (4-13-24)

CBS News Bay Area anchors Reed Cowan and Anne Makovec talk to Jill Beyer, OD, optometrist at Stanford Health Care, about how to safely watch a solar eclipse, and the kind of eye damage that can occur without proper protections

Mental illnesses like bipolar disease and schizophrenia can be debilitating, but a new study shows how the keto diet can help. The ketogenic diet is a high-fat, low carb diet. The idea is to help with weight loss by starving the body of carbs for fuel. On the flip side, it could increase bad cholesterol, and potentially raise the risk of heart problems. Dr. Shebani Sethi from Stanford Health Care is in the field of metabolic psychiatry, and CBS News Bay Area anchor Ryan Yamamoto asked her about keto, and how effective it could be when it comes to mental health disorders. "The ketogenic diet is a moderate protein diet, it often gets misconstrued as a high protein diet," said Dr. Sethi. "So it's a moderate protein diet, low carbohydrate, low fat, and it is an intervention that we do use." "Right now we've tested it in those with serious mental illness like schizophrenia and bipolar, and we think it's helpful because it's helping stabilize neuronal membranes, stabilize mood," said Dr. Sethi. "And in the study, what we did is look at a 4-month period to see what the outcome would be for psychiatric symptoms and we improvements in sleep, mood, quality of life, even in some cases reduction in hallucinations frequency and voices that we hear for those with schizophrenia and psychosis," said Dr. Sethi. "So it's been a promising, positive outcome in this pilot study, but there's more research to be do, of course." The study was published in ScienceDirect.

CBS News Bay Area anchor Ryan Yamamoto asks UC Berkeley Haas School of Business professor Olaf Groth, PhD, about the resignation of Boeing CEO Dave Calhoun and what that could mean for the company. Groth also discusses the DOJ's antitrust lawsuit against Apple, and electric vehicle startup Fisker's attempts to avoid bankruptcy

CBS News Bay Area anchor Ryan Yamamoto talks with Dr. Michael Greicius, professor of neurology and neurological sciences at Stanford Medicine, about how donanemab is supposed to work, and why the FDA made the decision to pull back on approval for now

The San Francisco Zoo is set to receive a pair of giant pandas under a memorandum of understanding signed Thursday by Mayor London Breed and the China Wildlife Conservation Association.

With the cancellation of the highly anticipated 4/20 marijuana festival in Golden Gate Park, cannabis enthusiasts are shifting their focus from Hippie Hill to local dispensaries.

A driver died after his vehicle plunged over a cliff along Highway 1 on the San Francisco Peninsula coast between Pacifica and Half Moon Bay Thursday.

A construction company whose employee died when the trench he was working in collapsed in San Francisco last year has been cited by Cal/OSHA for safety violations.

Despite San Francisco canceling its official 4/20 event in Golden Gate Park this year, people will still show up, and the Church of Ambrosia says it will be ready for them.

District Attorney Pamela Price on Thursday evening announced she plans to file charges against the three Alameda police officers involved in the 2021 in-custody death of Mario Gonzalez.

BART will run its legacy fleet of rail cars for the last time on Saturday, with the vintage trains traveling between MacArthur and Fremont stations.

One week after Oakland International Airport approved adding "San Francisco Bay" to its name, San Francisco officials have sued, claiming the new name infringes on the trademark of San Francisco International Airport (SFO).

The Oakland City Council on Tuesday unanimously approved the Oakland Ballers' plan to spend $1.6 million in upgrades to Raimondi Park, allowing the independent professional baseball team to play its inaugural 48 home games at the West Oakland park.

Officers shot and killed a homicide suspect from Sacramento in West Oakland Wednesday night, police said.

Investigators have found a connection between a mass shooting last month that left four people dead and the February killing of two cousins in Monterey County

A woman is suing San Jose's Leigh High School and the school district, claiming that after impregnating her as a student, a teacher forced her to have an abortion and then continued sexually abusing her.

Thirteen people have been arrested and about $150,000 in stolen items were recovered as authorities in the South Bay busted a suspected retail theft ring, deputies said Thursday.

Three people were arrested after multiple thefts at San Jose's Westfield Valley Fair shopping mall Monday and found with thousands of dollars in stolen merchandise, police said.

Three people have been arrested in connection with the kidnapping and torture of a man inside an East San Jose home earlier this year, police said Thursday.

Sonoma County supervisors on Tuesday took the unusual step of voting to reduce taxes on cannabis production, recognizing that the industry has hit hard times.

The Napa County District Attorney filed murder charges against a 22-year-old Vallejo man in connection to the fatal shooting of a woman and teen girl.

Police in San Rafael on Wednesday confirmed the arrest of a suspect who allegedly shot at a male victim in his car Monday evening.

Santa Rosa crews contained a residential fire caused by discarded oily rags early Wednesday morning, fire officials said.

Police arrested three people suspected in the fatal shooting of two women near downtown Napa over the weekend, the department announced Tuesday.

Despite being on the front lines of life-and-death situations, being a first responder can be a thankless job, which made one reunion on Wednesday extra special.

Creating change is not easy, but for one museum curator, it's her life mission.

A trio who's led the way in keeping San Mateo County beaches clean is launching a whale of an idea for Earth Day.

Two Peninsula mothers are encouraging San Mateo County youth to think about how they can care for the environment and express themselves using the video tools they already use.

San Francisco AAPI leaders say it seems obvious they're being targeted, but one case has them wondering just how seriously the justice system is taking it.

California pet owners struggling to find an apartment that accepts their furry, four-legged family members could have an easier time leasing new housing under proposed state legislation that would ban blanket no-pets policies and prohibit landlords from charging additional fees.

Twelve jurors and one alternate were seated in the first three days of jury selection in former President Donald Trump's New York criminal trial.

A disappearing lizard population in the mountains of Arizona shows how climate change is fast-tracking the rate of extinction.

The San Francisco Zoo is set to receive a pair of giant pandas under a memorandum of understanding signed Thursday by Mayor London Breed and the China Wildlife Conservation Association.

District Attorney Pamela Price on Thursday evening announced she plans to file charges against the three Alameda police officers involved in the 2021 in-custody death of Mario Gonzalez.

California law says genetic testing companies have to get your permission before they store, use or sell your DNA, but the state itself doesn't have to get your permission and has been storing DNA samples from every baby born there since the '80s. Lawmakers want to change that, but face an uphill battle.

Families of children with a rare autoimmune disorder are hoping new legislation in Sacramento will help their loved ones get the treatment they need.

Vice President Kamala Harris campaigned in Arizona Friday, where she blamed former President Donald Trump for the Arizona Supreme Court ruling earlier this week which could pave the way to revive a near-total abortion ban. Janet Shamlian has more.

A longtime Bay Area advocate for organ donations shared his personal story of helping a stranger earlier this year in an effort to inspire more people to donate life.

Most worrisome gaps involve cancer chemotherapy drugs, ER medications and and therapies for ADHD.

Twelve jurors and one alternate were seated in the first three days of jury selection in former President Donald Trump's New York criminal trial.

District Attorney Pamela Price on Thursday evening announced she plans to file charges against the three Alameda police officers involved in the 2021 in-custody death of Mario Gonzalez.

Investigators have found a connection between a mass shooting last month that left four people dead and the February killing of two cousins in Monterey County

A woman is suing San Jose's Leigh High School and the school district, claiming that after impregnating her as a student, a teacher forced her to have an abortion and then continued sexually abusing her.

Thirteen people have been arrested and about $150,000 in stolen items were recovered as authorities in the South Bay busted a suspected retail theft ring, deputies said Thursday.

Ever since the COVID-19 pandemic, the Oakland Unified School District has seen an alarming spike in the number of unhoused students in the school system who deal with a host of challenges far beyond what most children face.

Meteorologist and CBS News Bay Area's resident pilot Lt. Jessica Burch got a treat during Fleet Week, taking to the skies with one of the Blue Angels.

A Bay Area man discovered his devastating loss left him with a new opportunity to rethink how he lives -- follow his journey in virtual reality, 360-degree video.

A groundbreaking medical study involving the UCSF Medical Center has shown some colorectal cancer patients can safely skip radiation treatment and enjoy a potentially higher quality of life.

Every day, San Francisco bar pilot Captain Zach Kellerman goes through what might just be the world's most dangerous commute.

On Friday morning, a special ceremony held on board the USNS Harvey Milk paid homage to the San Francisco gay rights icon who is its namesake.

CBS News national security correspondent David Martin says the naming of the USNS Harvey Milk is a statement that LGBTQ+ rights matter in the U.S.

The naming of the USNS Harvey Milk is just one sign of a very different U.S. military than what many LGBTQ veterans experienced, including one Bay Area army veteran, who reflected on his painful exit from service and how things have changed.

The US Naval ship named after the late civil rights icon Harvey Milk arrived in San Francisco Bay Thursday afternoon, making its historic first visit to the Port of San Francisco.

The city of Sacramento is now a transgender sanctuary city, believed to be the first in California to vote for this designation.

Bay Area pop-punk heroes Green Day played an intimate show at the Fillmore in San Francisco Tuesday for a UN-backed global climate concert.

Bruce Springsteen and the E Street Band played the first of two long-delayed, sold-out concerts at San Francisco's Chase Center Thursday, delivering an epic 29-song set.

Austin-bred band the Black Pumas brought their mix of soul, jazz funk and simmering R&B to the Fox Theatre in Oakland for a packed, sold-out show on Feb. 8.

Riders faced heavy rain and sloppy track conditions at Oracle Park in San Francisco for the Monster Energy AMA Supercross event on Jan. 13.

Iconic electronic pop band Depeche Mode brought their "Memento Mori Tour" to Chase Center Sunday night, playing hits from the last four-plus decades to a full house.

A San Francisco-based nonprofit created by this week's Jefferson Award winner helps low income and unsheltered people stay healthy and feel good about themselves.

A trio who's led the way in keeping San Mateo County beaches clean is launching a whale of an idea for Earth Day.

Two Peninsula mothers are encouraging San Mateo County youth to think about how they can care for the environment and express themselves using the video tools they already use.

An Oakland man is bringing families together to break the cycle of violence in a neighborhood known for violent crime.

A San Francisco woman has spent more than a quarter century helping older adults and people with disabilities remain in their homes safely.

It's hard enough to graduate from one of the most prestigious schools in the country when you're the first in your family to go to college. Imagine doing that while you're also trying to protect your parents from being deported?

Some students who are the first in their families to go to college face the challenge of balancing a rigorous academic load while still working to help support their family back home.

A onetime pupil has now become a student advisor, giving back after years of mentorship led him to success.

Police departments all over the country are having a hard time finding new officers, but one Bay Area student is criss-crossing the world while preparing for a career in law enforcement here at home.

When most people graduate from college, they tend to focus on one job. But this month's Students Rising Above scholar is currently juggling multiple workplace assignments.