CBS News Live

CBS News Bay Area: Local News, Weather & More

Watch CBS News

Authorities in the East Bay on Friday have announced the arrests of three people in connection with a string of at least 11 armed robberies dating back to last summer.

Authorities in Pleasanton on Friday said that arriving first responders tried to render aid to one of the two children in Wednesday night's deadly crash that killed a family of four, but were unable to save the child.

Southbound Interstate Highway 680 will close from Friday night until Monday morning between the Interstate Highway 580 connector in Pleasanton and Koopman Road in Sunol, according to Caltrans.

Students at Stanford University have joined the national wave of protests on the war in Gaza on college campuses.

Prosecutors in former President Donald Trump's criminal trial in New York called two new witnesses to the stand on Friday, rounding out the first week of testimony.

The White House had been due to decide on the menthol cigarette rule in March.

It's almost the end of April, but Northern California still saw chain controls up in the high country on Friday.

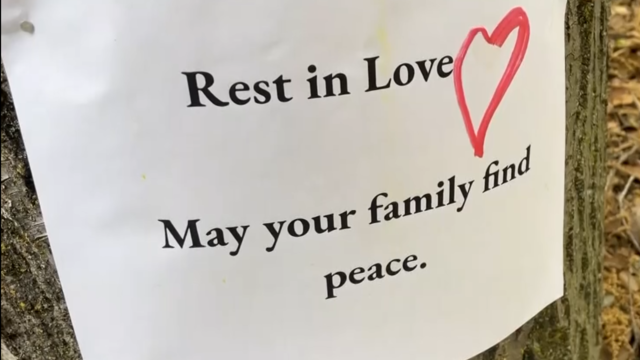

Oakland police officer Jordan Wingate, critically injured more than five years ago in a collision while responding to a call, was remembered by family and friends at a memorial Friday following his death last week from injuries suffered in the crash.

"I am happy to debate him," President Biden said during an interview with Howard Stern.

The Niners ended the first day of the NFL draft by adding a rookie receiver in Florida receiver Ricky Pearsall and keeping its established stars Aiyuk and Deebo Samuel.

The Oakland Athletics beat the New York Yankees 3-1 Thursday night for a four-game split.

The Las Vegas Raiders drafted Georgia's Brock Bowers with the 13th pick of the first round on Thursday, the second year in a row they have taken a tight end high in the NFL draft.

An unprecedented six of the first 12 picks were quarterbacks, an NFL Draft record.

Golden State Warriors point guard Stephen Curry led the league in clutch scoring this season, and was appropriately honored for his late-game heroics Thursday night.

Watts will raise awareness of serious issues impacting Californians, hold local officials accountable, obtain answers for viewers and provide solutions.

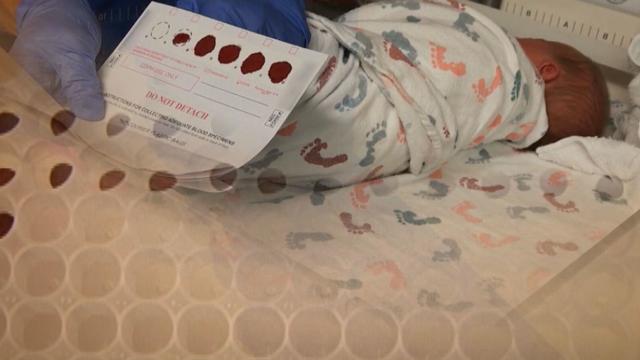

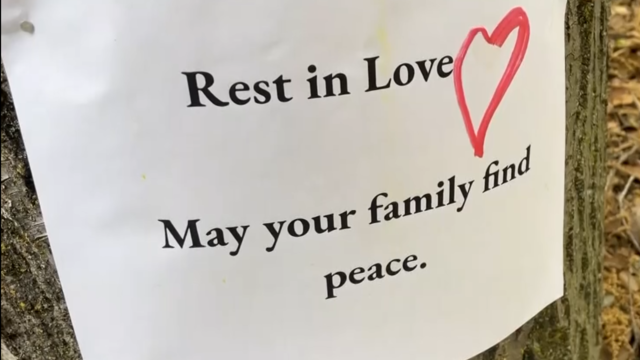

California law says genetic testing companies have to get your permission before they store, use or sell your DNA, but the state itself doesn't have to get your permission and has been storing DNA samples from every baby born there since the '80s. Lawmakers want to change that, but face an uphill battle.

A bill introduced in the wake of our "Handcuffs in Hallways" investigation aims to reduce "unnecessary" calls for police at schools. But one California lawmaker could kill it without a vote.

Students at Stanford University have joined the national wave of protests on the war in Gaza on college campuses.

Prosecutors in former President Donald Trump's criminal trial in New York called two new witnesses to the stand on Friday, rounding out the first week of testimony.

The White House had been due to decide on the menthol cigarette rule in March.

"I am happy to debate him," President Biden said during an interview with Howard Stern.

Mayor London Breed returned from her trip to China last weekend and is now making a visible push to fight for her job as she faces a tough re-election fight with several high-profile challengers.

Bay Area scientists are using cutting-edge technology to better understand the decline in bird populations while finding ways to help species that are challenged.

An innovative recycling start-up hopes to make the most of "wish-cycling" -- where people try to recycle things like prescription bottles and ballpoint pens, with no evidence they're ever properly processed.

Bay Area musicians are joining forces with an international alliance to call attention to the impact of climate change.

Students at an elementary school in San Rafael have become experts in the field of recycling, and have lessons for others who need a refresher, including those who work at CBS News Bay Area.

The Arctic fox, a captivating creature with a playful nature and distinctive look is under threat.

Darren Peck takes a look at how the gloomy-looking conditions around the Bay Area are about to change. Website: http://kpix.com/ YouTube: http://www.youtube.com/CBSSanFrancisco Facebook: https://www.facebook.com/CBSSanFrancisco Instagram: https://www.instagram.com/kpixtv/ Twitter: https://twitter.com/KPIXtv

Chief meteorologist Paul Heggen has the Bay Area microclimate forecast.

Darren Peck shows where in the Bay Area residents could see a few drops of rain. Website: http://kpix.com/ YouTube: http://www.youtube.com/CBSSanFrancisco Facebook: https://www.facebook.com/CBSSanFrancisco Instagram: https://www.instagram.com/kpixtv/ Twitter: https://twitter.com/KPIXtv

Expect unseasonably cool conditions to continue Thursday, with increased winds and highs in the 50s and 60s. Highs at seasonal norms are expected to return by the weekend. Paul Heggen has the forecast. Website: http://kpix.com/ YouTube: http://www.youtube.com/CBSSanFrancisco Facebook: https://www.facebook.com/CBSSanFrancisco Instagram: https://www.instagram.com/kpixtv/ Twitter: https://twitter.com/KPIXtv

CBS News Bay Area afternoon headlines for Friday Apr. 26, 2024. Watch full newscasts streamed at the CBS SF website or on the app. Website: http://kpix.com

Ryan Yamamoto reports on the latest Bay Area campus to join the protest effort showing support for Palestinians.

Bradley Blackburn reports on former National Enquirer publisher David Pecker finishing his testimony in Trump hush money trial.

Documents filed by the company shows workers in Palo Alto and Fremont will be among the company's mass layoffs. This comes as rising competition in the electric vehicle market caused Tesla's first quarter profit to plunge 55%. CBS News Bay Area anchor Ryan Yamamoto asks Olaf Groth, PhD, from UC Berkeley's Haas School of Business what this all means for the company and for California

“48 Hours” Correspondent, Erin Moriarty, spoke with Reed Cowan on the crime scene set in Hay, Kansas as investigators are divided on a cause of death. Watch the full report on Saturday, April 27th at 10 p.m. on KPIX and streaming on Paramount+. (04-26-2024) Website: http://kpix.com/ YouTube: http://www.youtube.com/CBSSanFrancisco Facebook: https://www.facebook.com/CBSSanFrancisco Instagram: https://www.instagram.com/kpixtv/ Twitter: https://twitter.com/KPIXtv

Documents filed by the company shows workers in Palo Alto and Fremont will be among the company's mass layoffs. This comes as rising competition in the electric vehicle market caused Tesla's first quarter profit to plunge 55%. CBS News Bay Area anchor Ryan Yamamoto asks Olaf Groth, PhD, from UC Berkeley's Haas School of Business what this all means for the company and for California

CBS News Bay Area anchor Ryan Yamamoto asks Dr. Molly Bowdring, psychiatry and behavioral sciences at Stanford Health Care, if people dealing with alcohol addiction should turn to non-alcoholic alternatives, what happens to the brain during addiction, and if non-alcoholic drinks help people with alcohol use disorder drink less

CBS News Bay Area anchor Ryan Yamamoto talks with Dr. Jyothi Tirumalasetty, Allergy & Immunology at Stanford Health Care, about this spring allergy season being worse from last, reasons why, and what we can do to minimize reactions.

Rep. John Garamendi (D-Walnut Grove) discussed Iran's air attack on Israel Saturday with KPIX anchors Brian Hackney and Andrea Nakano. (4-13-24)

CBS News Bay Area anchors Reed Cowan and Anne Makovec talk to Jill Beyer, OD, optometrist at Stanford Health Care, about how to safely watch a solar eclipse, and the kind of eye damage that can occur without proper protections

Mental illnesses like bipolar disease and schizophrenia can be debilitating, but a new study shows how the keto diet can help. The ketogenic diet is a high-fat, low carb diet. The idea is to help with weight loss by starving the body of carbs for fuel. On the flip side, it could increase bad cholesterol, and potentially raise the risk of heart problems. Dr. Shebani Sethi from Stanford Health Care is in the field of metabolic psychiatry, and CBS News Bay Area anchor Ryan Yamamoto asked her about keto, and how effective it could be when it comes to mental health disorders. "The ketogenic diet is a moderate protein diet, it often gets misconstrued as a high protein diet," said Dr. Sethi. "So it's a moderate protein diet, low carbohydrate, low fat, and it is an intervention that we do use." "Right now we've tested it in those with serious mental illness like schizophrenia and bipolar, and we think it's helpful because it's helping stabilize neuronal membranes, stabilize mood," said Dr. Sethi. "And in the study, what we did is look at a 4-month period to see what the outcome would be for psychiatric symptoms and we improvements in sleep, mood, quality of life, even in some cases reduction in hallucinations frequency and voices that we hear for those with schizophrenia and psychosis," said Dr. Sethi. "So it's been a promising, positive outcome in this pilot study, but there's more research to be do, of course." The study was published in ScienceDirect.

Students at Stanford University have joined the national wave of protests on the war in Gaza on college campuses.

San Francisco crews knocked down a two-alarm fire in the city's Presidio Heights neighborhood early Friday morning, fire officials said.

Pacifica police are seeking public assistance to find a man suspected of alleged arson near Fairway Park earlier this month.

In San Francisco, El Farolito soccer club, named after a beloved chain of Bay Area taquerias owned by Salvador Lopez, has flourished.

Mayor London Breed returned from her trip to China last weekend and is now making a visible push to fight for her job as she faces a tough re-election fight with several high-profile challengers.

Authorities in the East Bay on Friday have announced the arrests of three people in connection with a string of at least 11 armed robberies dating back to last summer.

Authorities in Pleasanton on Friday said that arriving first responders tried to render aid to one of the two children in Wednesday night's deadly crash that killed a family of four, but were unable to save the child.

Southbound Interstate Highway 680 will close from Friday night until Monday morning between the Interstate Highway 580 connector in Pleasanton and Koopman Road in Sunol, according to Caltrans.

Oakland police officer Jordan Wingate, critically injured more than five years ago in a collision while responding to a call, was remembered by family and friends at a memorial Friday following his death last week from injuries suffered in the crash.

A 27-year-old man has been charged with trying to kidnap a child earlier this month at a downtown Walnut Creek library and possessing hundreds of images of child pornography, authorities said Thursday.

Bay Area scientists are using cutting-edge technology to better understand the decline in bird populations while finding ways to help species that are challenged.

A former president of a San Jose elementary school enrichment program allegedly enriched herself by embezzling over $400,000 from the organization, police said Wednesday.

A bomb threat at San Jose City College Wednesday evening led the school to evacuate the campus and cancel all night classes, according to school officials.

The San Jose Sharks announced Wednesday that head coach David Quinn has been relieved of his duties, following one of the worst seasons in team history.

A caregiver to an elderly South Bay couple has been arrested on elder abuse charges after he allegedly used their debit card to steal thousands of dollars from the couple, deputies said Tuesday.

A man was sentenced earlier this week to 12 years and eight months in prison after he was convicted last year of molesting two children, Sonoma County prosecutors said.

If you're sick of scrolling through streaming services to find a movie to watch on your couch, the North Bay might be your next destination. A Benicia vintage store has set up a 'Free Blockbuster', and it's proving to be popular.

A houseboat went up in flames on Lake Berryessa in Napa County Wednesday, authorities said.

Two drivers were arrested in Santa Rosa after police said a road rage incident between the two led to a shootout Wednesday morning.

Petaluma officers arrested a parolee for allegedly assaulting someone at an apartment complex in the city earlier this week, according to police.

If you're sick of scrolling through streaming services to find a movie to watch on your couch, the North Bay might be your next destination. A Benicia vintage store has set up a 'Free Blockbuster', and it's proving to be popular.

A Redwood City man changed his career path - from running Stanford's Digital Language Lab to going to beauty school - so he could serve his community in a way that's more meaningful to him.

April is National Volunteer Month and organizations like the American Red Cross hope to inspire more people to join their work helping those in need following a disaster or emergency.

Reverend Cecil Williams, who co-founded Glide Memorial Church and dedicated his life to San Francisco's underserved community, died Monday at the age of 94.

Despite being on the front lines of life-and-death situations, being a first responder can be a thankless job, which made one reunion on Wednesday extra special.

Authorities in the East Bay on Friday have announced the arrests of three people in connection with a string of at least 11 armed robberies dating back to last summer.

Authorities in Pleasanton on Friday said that arriving first responders tried to render aid to one of the two children in Wednesday night's deadly crash that killed a family of four, but were unable to save the child.

Students at Stanford University have joined the national wave of protests on the war in Gaza on college campuses.

Prosecutors in former President Donald Trump's criminal trial in New York called two new witnesses to the stand on Friday, rounding out the first week of testimony.

The White House had been due to decide on the menthol cigarette rule in March.

The White House had been due to decide on the menthol cigarette rule in March.

The California Department of Public Health issued a warning to distributors and retailers to not sell raw oysters from a Korean company over a potential link to norovirus cases.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

The CDC estimates the U.S. could reach 300 measles cases in 2024 — more than the recent peak two years ago.

California law says genetic testing companies have to get your permission before they store, use or sell your DNA, but the state itself doesn't have to get your permission and has been storing DNA samples from every baby born there since the '80s. Lawmakers want to change that, but face an uphill battle.

Authorities in the East Bay on Friday have announced the arrests of three people in connection with a string of at least 11 armed robberies dating back to last summer.

Oakland police officer Jordan Wingate, critically injured more than five years ago in a collision while responding to a call, was remembered by family and friends at a memorial Friday following his death last week from injuries suffered in the crash.

A man was sentenced earlier this week to 12 years and eight months in prison after he was convicted last year of molesting two children, Sonoma County prosecutors said.

A 27-year-old man has been charged with trying to kidnap a child earlier this month at a downtown Walnut Creek library and possessing hundreds of images of child pornography, authorities said Thursday.

Pacifica police are seeking public assistance to find a man suspected of alleged arson near Fairway Park earlier this month.

Ever since the COVID-19 pandemic, the Oakland Unified School District has seen an alarming spike in the number of unhoused students in the school system who deal with a host of challenges far beyond what most children face.

Meteorologist and CBS News Bay Area's resident pilot Lt. Jessica Burch got a treat during Fleet Week, taking to the skies with one of the Blue Angels.

A Bay Area man discovered his devastating loss left him with a new opportunity to rethink how he lives -- follow his journey in virtual reality, 360-degree video.

A groundbreaking medical study involving the UCSF Medical Center has shown some colorectal cancer patients can safely skip radiation treatment and enjoy a potentially higher quality of life.

Every day, San Francisco bar pilot Captain Zach Kellerman goes through what might just be the world's most dangerous commute.

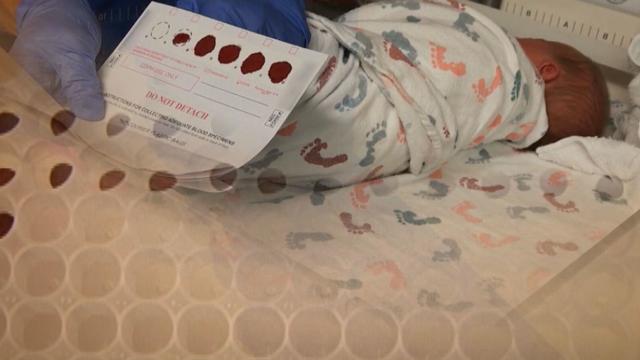

One of San Francisco's oldest LGBTQ bars, on Saturday the Stud re-opened it's doors for the first time in four years at a new location.

A California judge has tentatively sided with state Attorney General Rob Bonta in a dispute over the title of a proposed ballot measure that would require school staff to notify parents if their child asks to change gender identification at schools.

On Friday morning, a special ceremony held on board the USNS Harvey Milk paid homage to the San Francisco gay rights icon who is its namesake.

CBS News national security correspondent David Martin says the naming of the USNS Harvey Milk is a statement that LGBTQ+ rights matter in the U.S.

The naming of the USNS Harvey Milk is just one sign of a very different U.S. military than what many LGBTQ veterans experienced, including one Bay Area army veteran, who reflected on his painful exit from service and how things have changed.

Bay Area pop-punk heroes Green Day played an intimate show at the Fillmore in San Francisco Tuesday for a UN-backed global climate concert.

Bruce Springsteen and the E Street Band played the first of two long-delayed, sold-out concerts at San Francisco's Chase Center Thursday, delivering an epic 29-song set.

Austin-bred band the Black Pumas brought their mix of soul, jazz funk and simmering R&B to the Fox Theatre in Oakland for a packed, sold-out show on Feb. 8.

Riders faced heavy rain and sloppy track conditions at Oracle Park in San Francisco for the Monster Energy AMA Supercross event on Jan. 13.

Iconic electronic pop band Depeche Mode brought their "Memento Mori Tour" to Chase Center Sunday night, playing hits from the last four-plus decades to a full house.

A Redwood City man changed his career path - from running Stanford's Digital Language Lab to going to beauty school - so he could serve his community in a way that's more meaningful to him.

A San Francisco-based nonprofit created by this week's Jefferson Award winner helps low income and unsheltered people stay healthy and feel good about themselves.

A trio who's led the way in keeping San Mateo County beaches clean is launching a whale of an idea for Earth Day.

Two Peninsula mothers are encouraging San Mateo County youth to think about how they can care for the environment and express themselves using the video tools they already use.

An Oakland man is bringing families together to break the cycle of violence in a neighborhood known for violent crime.

It's hard enough to graduate from one of the most prestigious schools in the country when you're the first in your family to go to college. Imagine doing that while you're also trying to protect your parents from being deported?

Some students who are the first in their families to go to college face the challenge of balancing a rigorous academic load while still working to help support their family back home.

A onetime pupil has now become a student advisor, giving back after years of mentorship led him to success.

Police departments all over the country are having a hard time finding new officers, but one Bay Area student is criss-crossing the world while preparing for a career in law enforcement here at home.

When most people graduate from college, they tend to focus on one job. But this month's Students Rising Above scholar is currently juggling multiple workplace assignments.